Introduction

With General Motors (GM) and Hyundai stepping away from the robotaxi race, Waymo has emerged as the only viable robotaxi business in the West. However, it looks like many, including those whose futures are directly affected by this industry shift, seem to be dangerously underestimating its implications.

This transformation in the autonomous driving (AV) landscape signals both incredible opportunity for Waymo and an existential threat to ride-hailing giants Uber and Lyft. If Uber and Lyft continue to operate like glorified taxi services, they won’t survive the coming storm. They should be proactive and reclaim their identity as tech companies they once were or else they will perish.

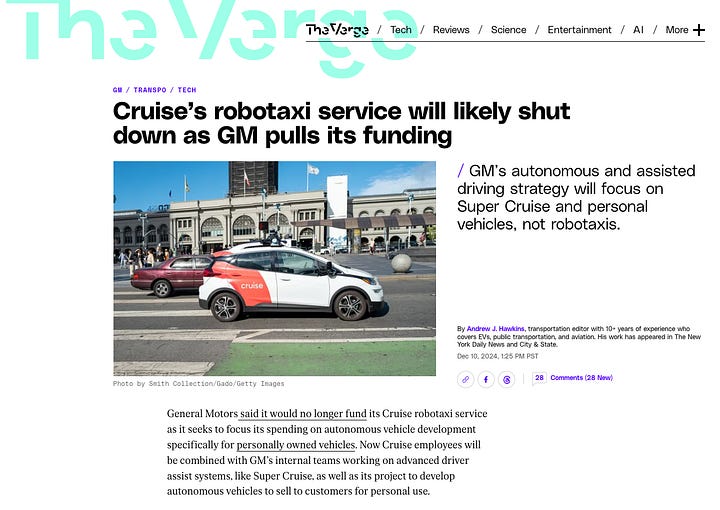

Why GM and Hyundai Ditched Robotaxis

The decisions by GM and Hyundai to deprioritize robotaxis in favor of Level 3 (L3) autonomous driving systems aren’t surprising when you understand their motivations. Automakers were never truly committed to the robotaxi dream—they were chasing the hype.

Back in 2018, when the promise of fully autonomous (L5) driving seemed tantalizingly close, these companies spun off independent robotaxi ventures to capitalize on investor enthusiasm. They secured funding from desperate investors and partnered with other OEMs, all while boosting their balance sheets and handing their CEOs hefty bonuses year after year. For a while, the strategy worked: they looked innovative, attracted capital, and surfed the wave of AV optimism.

But as the hype died down and the true costs of achieving L5 autonomy became clear, the flaws in the robotaxi business model emerged. Automakers realized that their role would be reduced to supplying commoditized vehicles for fleet owners like Waymo or Cruise. Faced with mounting development costs and an increasingly unattractive outlook, they pivoted.

By focusing on L3 autopilots, automakers have taken a more pragmatic approach. This strategy allows them to integrate self-driving technology as a high-margin add-on to consumer vehicles, retaining control over their core business. It’s a safer bet, letting them stay in the autonomy game without the operational complexities and financial risks of running a robotaxi fleet.

The Rise of Waymo as the Last Standing Robotaxi Pioneer

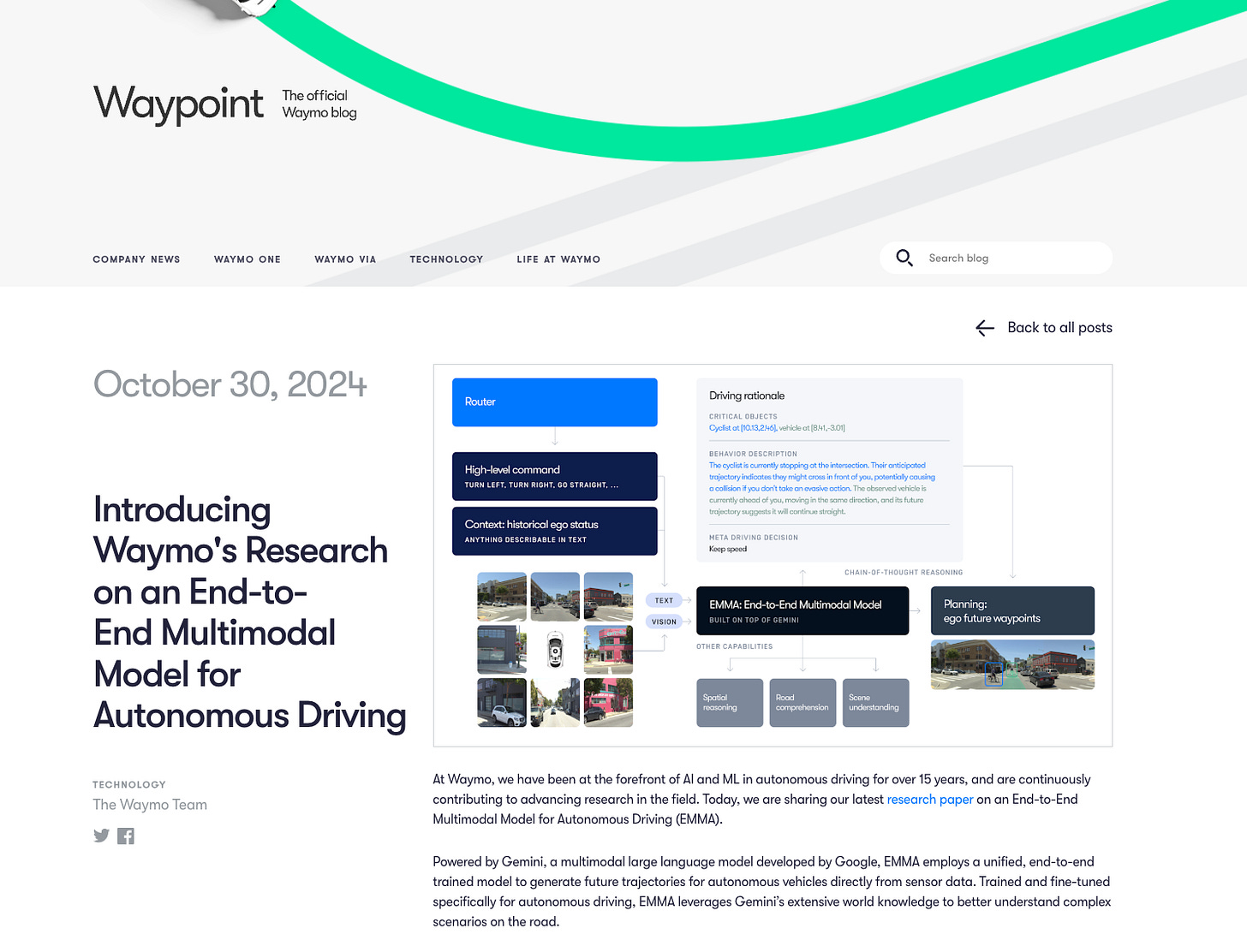

With Cruise’s departure and automaker pullbacks, Waymo has solidified itself as the leader in the Western robotaxi space — unless Tesla enters in the near future. Contrary to popular belief, the rapid advancements in artificial intelligence (AI) are accelerating Waymo’s timeline to scale. The perception that full self-driving (L5 autonomy) is still a distant dream is outdated; the explosion of foundational AI models, self-supervised learning, and faster training techniques are dramatically shrinking the timeline.

Moreover, regulatory hurdles, while historically challenging, are no longer the most significant bottleneck. Waymo’s deep pockets, engineering talent, and the ability to leverage AI breakthroughs position it for an aggressive expansion in the coming years. If they execute well, Waymo’s fleet of robotaxis could be ubiquitous far sooner than skeptics expect.

How the AV Industry Fell Apart and Why Waymo Stands Out

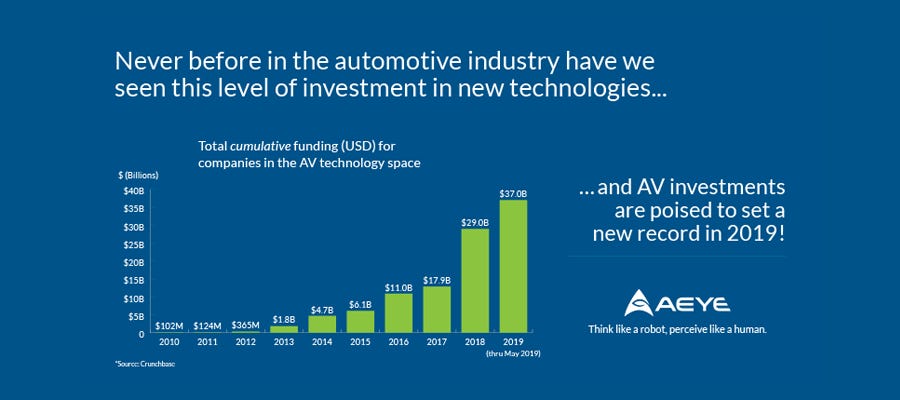

The AV industry’s early meteoric rise was fueled by massive capital injections and inflated expectations. This led to bloated teams, siloed engineering efforts, and a rush to prematurely optimize for scale.

As AI advanced, smaller models that once solved narrow problems began converging into large, general-purpose foundation models. However, adopting these new techniques required breaking down silos and restructuring teams. Many employees of AV companies resisted out of job security concerns and organizational inertia.

The decline in hype and the exodus of talent to more lucrative opportunities in generative AI further polarized the industry. Now, only top players like Waymo and Tesla can attract the best engineering talent and invest in cutting-edge AI. As a result, their AV technologies are advancing faster than ever. Waymo, in particular, is leveraging powerful AI models and pushing ahead with a vision of scalable robotaxi fleets.

For everyone else, it’s a game of survival in the shadow of giants.

Why Uber and Lyft Are in Danger

Uber and Lyft are precariously close to becoming obsolete in a world dominated by robotaxis. Both companies may feel excited about offering Waymo rides on their platforms, but this strategy is riddled with problems.

Waymo’s goal isn’t to become a mere supplier to Uber and Lyft. It wants to dominate the market by replacing them entirely. Using Uber and Lyft as initial distribution channels is a smart way for Waymo to expand its reach while building its own platform. Once Waymo achieves sufficient scale, it can bypass Uber and Lyft entirely, saving costs and monopolizing the ride-hailing market with cheaper robotaxi services.

Uber and Lyft, reliant on human drivers, cannot compete on cost with robotaxis. Labor is the most significant expense in ride-hailing, and the economics of human-driven rides simply cannot match those of autonomous fleets. The longer Uber and Lyft wait, the narrower their options become.

What Uber and Lyft Need to Do Right Now

Uber and Lyft have lost their identity as tech companies. Since 2017, they’ve been operating more like banks, focused on financial metrics and short-term gains. It is impossible to find signs of the innovative disruptors they once were. If they want to survive, they need to shift their focus back to creating value through technology. Here’s how:

Acquire or Develop AV Technology

Selling Uber’s AV division to Aurora was a colossal mistake. To compete with Waymo, Uber must acquire an AV software startup or start rebuilding its autonomous driving capabilities. Lyft, too, needs to explore similar options. Without proprietary AV technology, they will remain dependent on Waymo, which is a recipe for disaster.

Negotiate Long-Term Exclusivity Deals with Waymo

Uber and Lyft must convince Waymo to sign long-term, exclusive partnerships—perhaps a 30-year deal—ensuring they remain a critical part of Waymo’s strategy. Without exclusivity, Waymo has every incentive to cut them out as soon as it achieves scale.

Act Like Tech Companies Again

It’s time to abandon the mindset of a fancy taxi company and go back to their root as a tech company. This means reinvesting in technology-driven products, reorganizing for agility, and attracting top-tier talent. Uber and Lyft must position themselves as active participants in the AV revolution, not passive platforms hoping to piggyback on Waymo’s success.

Clock Is Ticking

The future of transportation is arriving faster than expected, and Waymo is leading the charge. With GM and Hyundai out of the picture and the AV landscape consolidating, Waymo has an unprecedented opportunity to monopolize the robotaxi market. For Uber and Lyft, this is a make-or-break moment.

The decisions they make in the next 1-2 years will determine whether they thrive in the autonomous era or fade into irrelevance. It’s time for these companies to wake up, rediscover their roots as tech pioneers, and execute with the urgency that the situation demands. Otherwise, the robotaxi revolution will leave them behind.